Stand Up for Super

All Australians deserve a decent retirement.

Australia’s universal superannuation system is the difference between poverty and a decent retirement for most Australians. Superannuation and the decisions that are made today will have a far-reaching impact on what retirement looks like for all hard-working Australians:

- It is the difference between using the heater during winter and having to shiver under a blanket.

- It is the difference between a healthy balanced diet or instant noodles for dinner.

- It is often the difference between being able to afford vital medications or not.

- Australian families are worried about their future.

Just one in five Australians with superannuation said they expected to be able to live comfortably off their super in retirement. Many Australian women are retiring in poverty; older women are the fastest-growing cohort of people experiencing homelessness in Australia today.

What we want:

- Protecting our universal superannuation system and rejecting any attempts to make super optional for Australian workers

- Keeping to the promised Superannuation Contribution Guarantee rate increase to 12%

- Closing the retirement gender super gap by paying a superannuation contribution at the prevailing SGC rate for the government’s paid parental leave scheme and on all government career & family payments

Join our campaign.

Every day we ignore this problem, the impact gets worse. Cost of living is going up and we are living longer. Urgent action needs to be taken to get super working for women.

We need to lock in a secure retirement for all women. We must upgrade the super system we’ve already built to guarantee a secure, dignified retirement for all working people.

Sign our petition here.

28 February Update: Tax Concessions in Super - Federal Government Closes Loophole!

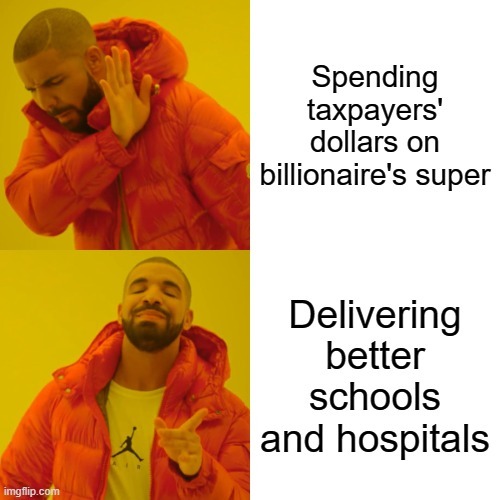

The Government announced it would be reducing tax concessions available for the richest Australians through superannuation.

Earnings for people with balances greater than $3 million will now be taxed at 30%, rather than 15%, providing the budget with about $2 billion a year in revenue.

The union movement obviously welcomes the elimination of this enormous tax loophole for the very rich, and we can already see the Opposition and parts of the media swing in to attack the policy. Despite it only hitting the 80,000 richest Australians, they will try and smash it down.

This small step towards tax fairness will be an important fight to win.

In order to help win it, the ACTU has put together the attached short explainer on the tax concessions and the reasons why they’re important, for your use. Included in that explainer is how this connects to the objective of super debate. Read it here.